Earn 1

Earnings at risk – Google AdSense Error

Earnings at risk – You need to fix some ads.txt file issues to avoid severe impact to your revenue.

If you’re seeing an “Earnings at risk – Google AdSense Ads.txt error” message in your AdSense account, it means that there is an issue with the ads.txt file on your website. Here are some steps you can take to resolve this error:

- Verify the existence of the ads.txt file: First, ensure that the ads.txt file exists on your website. You can do this by going to yourwebsite.com/ads.txt. If the file doesn’t exist, create a new one in your website’s root directory.

- Check the content of the ads.txt file: Make sure that the content of the ads.txt file is correct. The file should include the AdSense publisher ID and the AdSense code snippet. You can find your publisher ID in your AdSense account by clicking on “Account information” in the left sidebar.

- Confirm the ads.txt file is publicly accessible: Check that the ads.txt file is publicly accessible on your website. To do this, try accessing the file from a different browser or computer, or check if it is blocked by a robots.txt file.

- Ensure the ads.txt file is updated: Check that the ads.txt file is updated regularly. AdSense recommends that you update the file at least once a month to ensure that it accurately reflects your authorized sellers.

- Wait for the changes to propagate: After making any changes to the ads.txt file, wait for the changes to propagate through the internet. This can take up to 24 hours.

By following these steps, you should be able to resolve the “Earnings at risk – Google AdSense Ads.txt error” and ensure that your AdSense earnings are not impacted by any ads.txt issues.

Important! – Google AdSense www & non-www Error – ads.txt

if your website not redirected properly AdSense bot will not recording your ads.txt file.

Check your website is working for either,

- yoursite.com/ads.txt

- www.yoursite.com/ads.txt

Ex :

if your site configured only for WWW version, you should create a 301 permeant redirect from non-WWW version to WWW version in order to make ads.txt file readable for both versions.

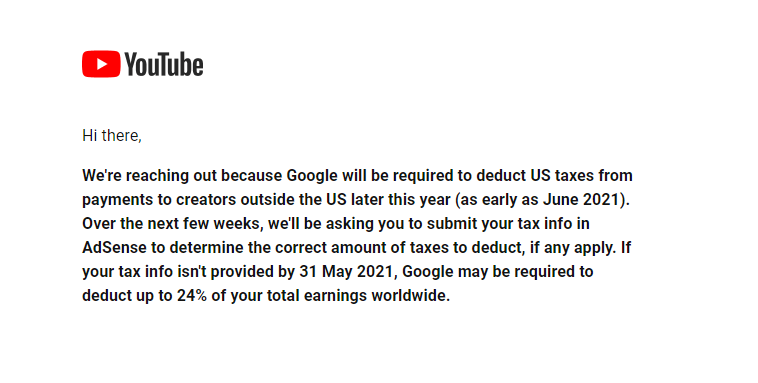

YouTube will be deducting up to 24% TAX for all non-US creators

YouTube will be deducting up to 24% TAX for all non-US creators, starting as early as June 2021. This will impact a lot of channels moving forward.

From Google : “We’re reaching out because Google will be required to deduct U.S. taxes from payments to creators outside of the U.S. later this year (as early as June 2021). Over the next few weeks, we’ll be asking you to submit your tax info in AdSense to determine the correct amount of taxes to deduct, if any apply. If your tax info isn’t provided by May 31st, 2021, Google may be required to deduct up to 24% of your total earnings worldwide“

This will only apply to revenue generated through U.S. viewers but will still impact thousands of creators.

YouTube is making a change to how payments are conducted for partnered creators outside of the U.S. Google announced today that it will start deducting U.S. taxes from future payments from the platform starting later this year.

This will only impact earnings generated by viewers within the U.S. and will go into effect as early as June, according to the official YouTube Creators account.

Google will begin deducting taxes from non-U.S. creators on earnings generated by U.S. viewers through ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships. This will apply to all members of the YouTube Partner Program and a prompt to submit updated tax information through Google AdSense will be sent out over the next few weeks.

YouTube also said that creators could see up to a 24-percent deduction from their total earnings if their tax information is not properly updated by May 31.

On a support page, Google also clearly outlines an example of this impact.Example: A Creator in India earns $1,000 in revenue from YouTube in the last month. Of the $1000 in total revenue, their channel generated $100 from U.S. viewers. Here are some possible withholding scenarios:

- Creator doesn’t submit tax info: Final deduction is $240 because the withholding tax rate if you don’t submit a form is up to 24% of total earnings. This means that until we have your completed tax info, we’ll need to deduct up to 24% of your total earnings worldwide – not just your U.S. earnings.

- Creator submits tax info and claims a treaty benefit: Final tax deduction is $15. This is because India and the U.S. have a tax treaty relationship that reduces the tax rate to 15% of earnings from viewers in the U.S.

- Creator submits tax info, but is not eligible for a tax treaty: Final tax deduction is $30. This is because the tax rate without a tax treaty is 30% of earnings from viewers in the U.S.

This change won’t affect creators in the United States, but will affect the rest of the world. YouTube needs updated tax info by the end of May, otherwise a default 24% cut will be made, which, obviously, would be detrimental to many who rely on the platform to make a living.

Most viewed